ACH vs Wire Transfer

When businesses or individuals need to make international transfers or transfer funds between bank accounts either domestically or anywhere globally, they're faced with a number of choices as to how to do it.

So what are the best options? In this blog we'll look at the various ways in which to transfer funds, and highlight the key differences between each payment processing method. Let's start with the two most common ways to carry out a money transfer, and define what they are - ACH and Wire Transfer.

What is an ACH transfer?

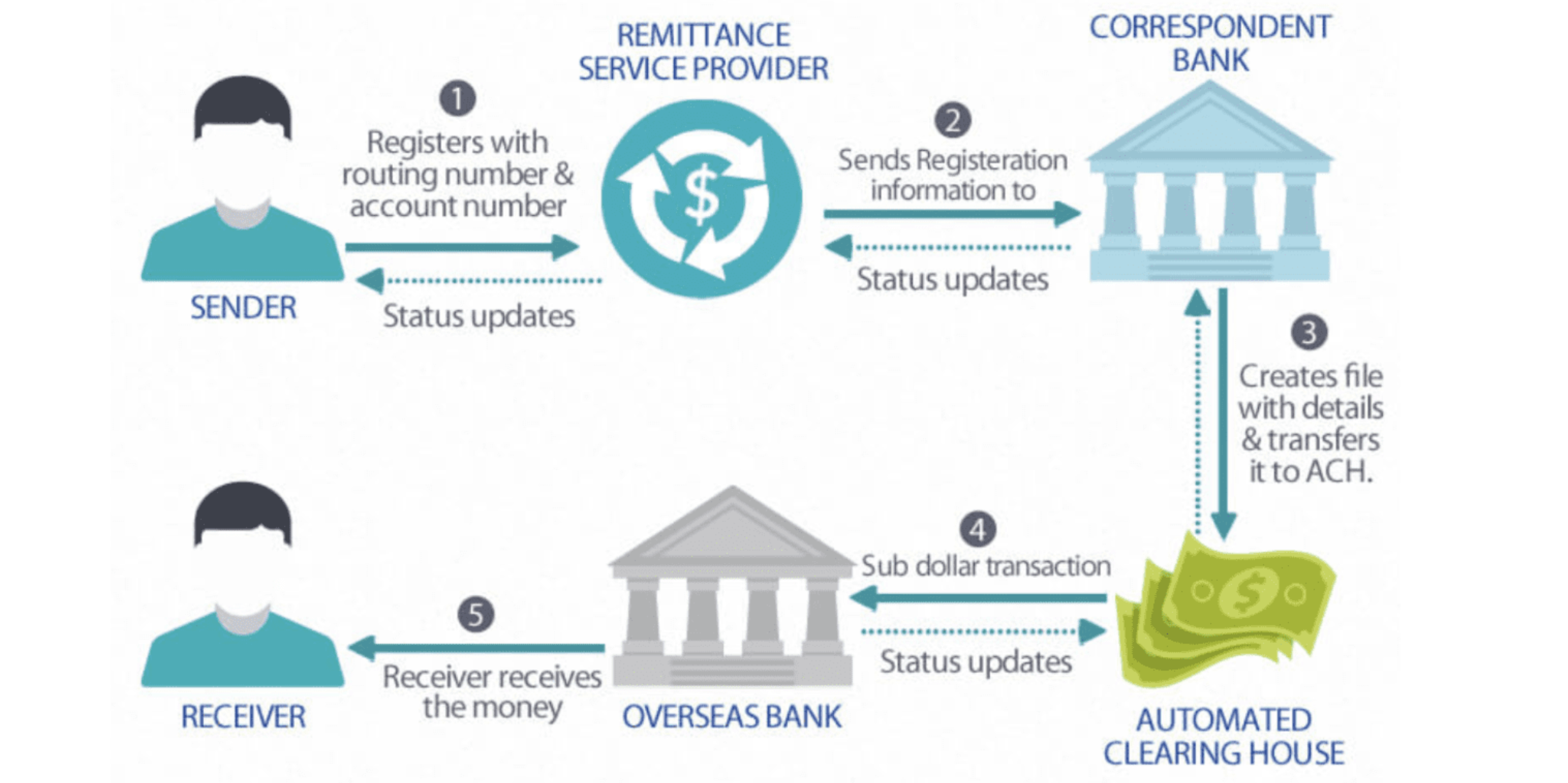

The Automated Clearing House (ACH) network is a system for moving money between accounts in the US. It’s a digital process that has largely replaced the paper check, to improve speed and efficiency and reduce the need for manual human input.

An ACH transfer is often referred to by more recognizable names like direct deposit, direct debit, auto-pay, Electronic Funds Transfers (EFTs), and the generic term “bank transfer”. The ACH system is also the underlying technology behind most peer-to-peer transfers made through services like Venmo, PayPal, Cash App, and Zelle.

Around 10,000 financial institutions use the Automated Clearing House Network to facilitate ACH payments.

There are two categories for which consumers and businesses can use ACH transfers.

Direct payments (ACH debit transactions)

Direct payment via ACH withdrawal takes funds from accounts via either credit or debit and is used for things like paying bills. ACH payments make the payment process easier for potential customers compared to writing a check, increasing chances of converting them to a sale.

And, in the case of recurring purchases, ACH transactions can be automatic - meaning the customer doesn’t need to worry about receiving and paying a bill; it will be automatically transferred from their bank account.

Direct deposits (ACH credit transactions).

An ACH direct deposit delivers funds into a bank account as credit and is used for purposes such as payroll and tax refunds, employee expense reimbursement. A direct deposit covers all kinds of deposit payments from businesses or government to a consumer. This includes government benefits, tax and other refunds, annuities and interest payments.

Some financial institutions also offer bill payment, which allows you to schedule and pay bills electronically using ACH transfers. Or through the ACH network you can initiate an ACH transfer to individuals or merchants internationally. Business owners can also use ACH transfers to pay vendors or employees.

Image source: Avada

Read our 'Complete Guide to Understanding ACH Payments' here

What is a wire transfer?

A wire transfer is another electronic payment service used to move money between bank accounts. Wire transfers typically transfer money for a same-day arrival, but an expedited service comes at a premium.

Wire transfers originated in the days of the telegraph wire, and are direct point-to-point transfers between any two financial institutions. There are two types of wire transfers: domestic and international. International transfers are also called remittance transfers, international wires or international money transfers, and must be for more than $15 when sent from the United States to another country. Wire transfers are typically used for higher-value items like property purchases or for settling large institutional transactions.

The key differences between ACH and wire transfers

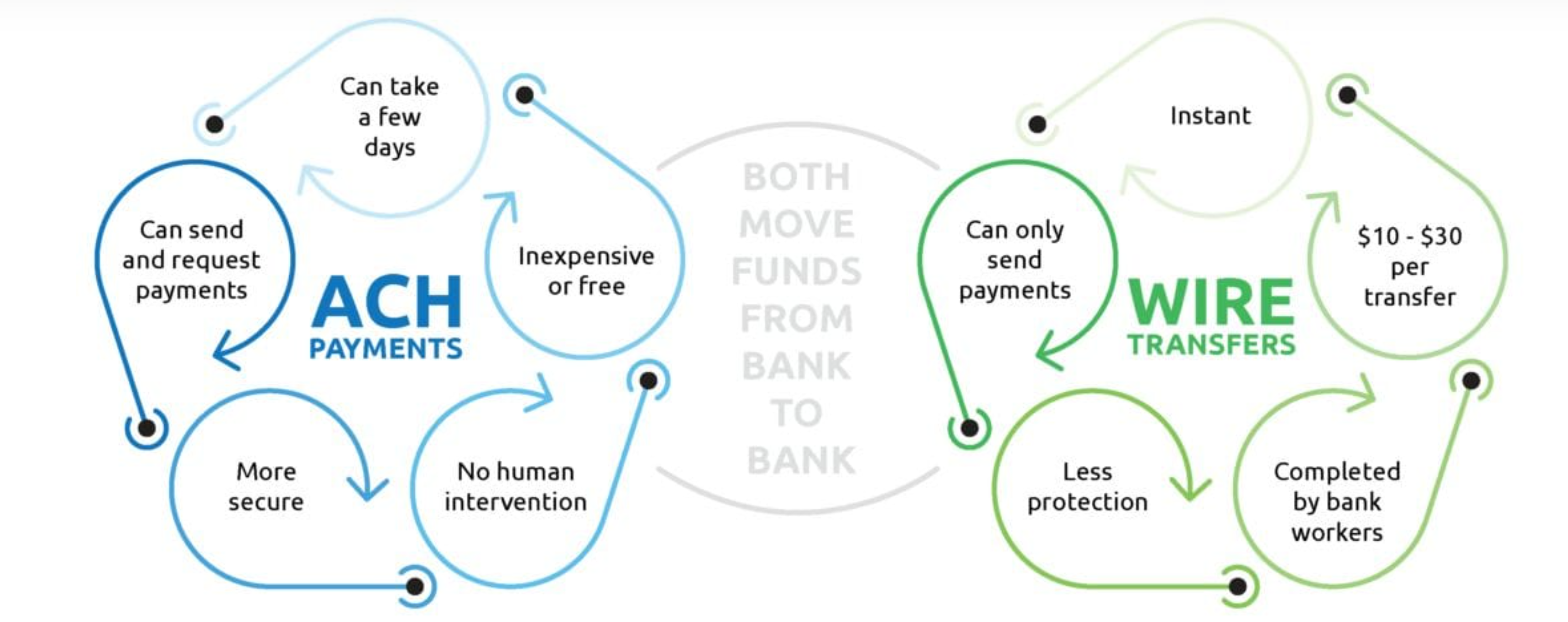

Even though ACH transfers and wire transfers seem similar, their points of difference are important to understand for anyone needing to move money from one bank account to another.

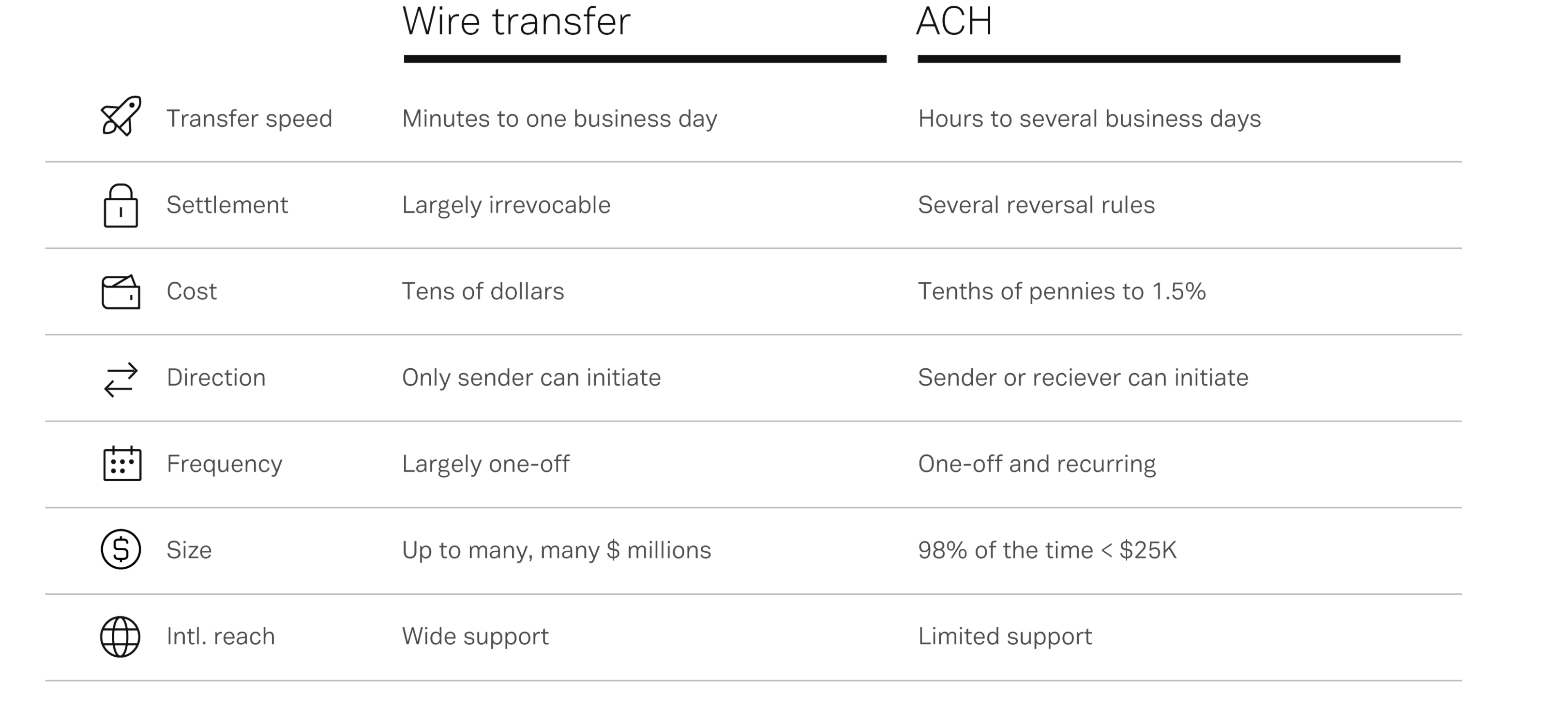

Speed

ACH transfers can take several business days - on the days that banks are open, usually not weekends or holidays as they are processed by a network operator in batches only seven times a day.

Financial institutions can choose to have ACH credits processed and delivered within the same day, or in one to two business days. In contrast, ACH debit transactions must be processed by the next business day. These timelines are based on rules from the National Automated Clearing House Association, or NACHA, the trade group that oversees the network. Upon receiving the money, a bank or credit union might also hold these transferred funds for a period of time, so the total delivery time from one bank to another varies.

Wire transfers send the funds along almost immediately through real-time processing. There is usually no hold on funds received by wire transfer, so the recipient can access funds right away.

Read more about how 'Real Time Payments are Changing The World' here

Cost

ACH costs are generally lower than other popular payment methods, typically costing an average of one dollar per transaction, depending on transaction volume. Some businesses however, may have to pay a separate fee from $5 to $30 per month to use ACH for transferring money. There are also additional potential charges like return fees (from $2 to $5 per return) and reversal or chargeback fees ($5 to $25). Generally, the greater the volume of ACH transactions, the less the fees per transaction.

Wire transfers can incur costs for both the sender and the recipient. Many financial institutions charge $10 to $35 dollars to send, and smaller institutions may charge a fee to receive a wire transfer. On the high end, those costs can add up to about $55 when combining all fees, and international transfers can cost even more. Because of the costs involved and speed, a wire transfer is most suited to large-sum and time-sensitive transfers, either in the U.S. or abroad

Payment security

ACH transfers are a little more secure for senders. Unlike most wire transfers, funds can be reversed in cases of fraud or payment error. The criteria for reversals is usually determined by banks.

Wire transfers have little disadvantage for the recipient. When you receive a wire transfer, the funds are accessible immediately.

Similar to cashier’s checks, wire transfers can be relatively easy to fake, so for senders, there is a little more risk. It’s important to know and confirm the person or account the wire transfer is being sent to, because the money can be withdrawn right away and often the transaction can not be reversed once it is sent.

ACH vs Wire Transfer

Image source: Avidxchange

ACH transfer limits vs wire transfer limits

ACH transfers are subject to limits on how much money can be moved. These limits can be per day, per single transaction or per single month and range from $10,000 per month to as high as $25,000 a month depending on the bank.

However, other banks have much stricter ACH transaction amount limits, which can be as low as $2,000 a month, so it's important to determine for what purpose you'll be using ACH transfers.

Wire transfers also have limits, but in general they are higher than ACH transfers. As with an ACH transfer, many major banks impose a per-day or per-transaction wire transfer limit.

For example, Chase Bank sets the limit at $100,000 for individuals, but offers higher limits to businesses on request. Citi imposes various amounts depending on the type of account, but it ranges between $1,000 and $10,000 online. Fidelity allows up to $100,000 per transfer and $250,000 per day. Both the sending the receiving banks typically impose a small fee for wire transfers.

Global differences

Wire transfers are widely used internationally, while ACH transfers are currently only used in the US and a few special bilateral agreements.

Wire transfers are broadly supported internationally, with a mature network of correspondent banks allowing transfers across countries and currencies with usually only one or two intermediary stops. Though currency exchange fees can be quite costly at 2-3%.

ACH transfers are largely limited to the US. While there have been occasional pushes for more interoperability between major ACH-like networks globally, the number of parties required to coordinate this is quite high.

Summary of differences between ACH vs wire transfer

Image source: Plaid

Alternatives to Wire Transfers

The term wire transfer is sometimes used to describe various alternative electronic transfer methods when sending money abroad or domestically. These methods are useful when a sender doesn't want to use a traditional bank wire transfer. Not all of them are as instant or safe as bank wire transfers, and can incur more costs.

Money Transfer Services

Financial services companies like Western Union operate independently. You can use cash for an in-person transfer at a Western Union branch if you don't want to submit bank account information, or you can carry out transactions online. How much time this type of transfer will need varies. It could take a few minutes or a few days. The recipient picks up the money at a specified location at the other end, and is identified through personal information like their name and address.

P2P Payment Tools

Person-to-person (P2P) services are often easy and inexpensive to use. They include PayPal, Venmo, Zelle, and Popmoney. Each tool has different time frames for transfers. Popmoney, for example, enables three-day standard transfers from bank accounts.

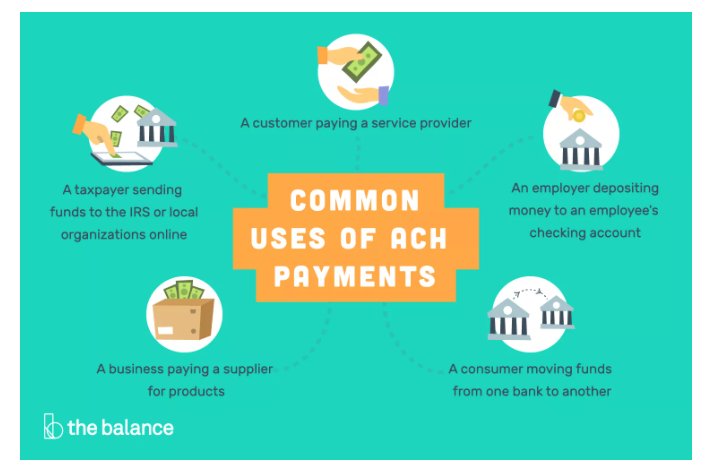

Choosing between ACH and wire transfers

It depends on your requirements whether you choose to use ACH or wire transfer. ACH transfers can be a less expensive way to move money, but for the sender, it's important to know your bank’s policy first. This will help you avoid any fees, processing delays and potential limits so you can make the most out of this service.

Image source: The Balance

The changing payments environment

Payments ecosystems can be extremely complex and shifting consumer behavior, along with expectations of omni-commerce is emerging at lightning speed. The demand for faster payments, better security, flexibility in payment methods is increasing.

With the influx of new and emerging technologies and new payment methods, organizations are finding that they need better ways to effectively manage booming transaction volumes, emerging technologies, regulatory challenges' and higher customer expectations.

Whether your organization uses ACH payment methods, international wire transfers, wire transfers, or other bank to bank networks, you need real-time visibility and payment monitoring throughout your entire payment environment.

Managing your payments environment with IR Transact

IR Transact simplifies the complexity of managing modern payments ecosystems. Bringing real-time visibility and payment monitoring to your entire environment, Transact uncovers unparalleled insights into transactions and trends to help you streamline the payments experience, and turn data into intelligence.

Transaction monitoring provides real time insights into customer transactions, including historical as well as current information and interactions. This provides a complete picture of the activities from all your customers, including transfers, deposits, and withdrawals to automatically analyze this data.

Organizations, as well as financial institutions, acquirers and payments processors need to have complete real-time visibility into their payments ecosystems. Poorly performing systems increase frustration throughout the entire payments chain, increasing the likelihood of abandoned purchases, customer dissatisfaction, service disruption and ultimately the potential of lost revenue.