The payment industry globally is in transition, converging from a wide variety of legacy financial message and data formats to ISO 20022. This common, global, end-to-end messaging standard is streamlining the financial services industry with its highly structured data exchanges, improved message flows and more accurate compliance processes.

Because the ISO 20022 financial messages format features richer data elements and more detailed remittance information, it enables better interoperability between FIs, market infrastructures and customers worldwide.

What are the benefits of ISO 20022?

When ISO 20022 was first introduced in 2004, it was created to give the financial industry a common platform for sending payments messages and exchanging payments data, using a central dictionary, a standard modelling methodology, and a series of Extensible Markup Language (XML) and Abstract Syntax Notation (ASN.1 ) protocols.

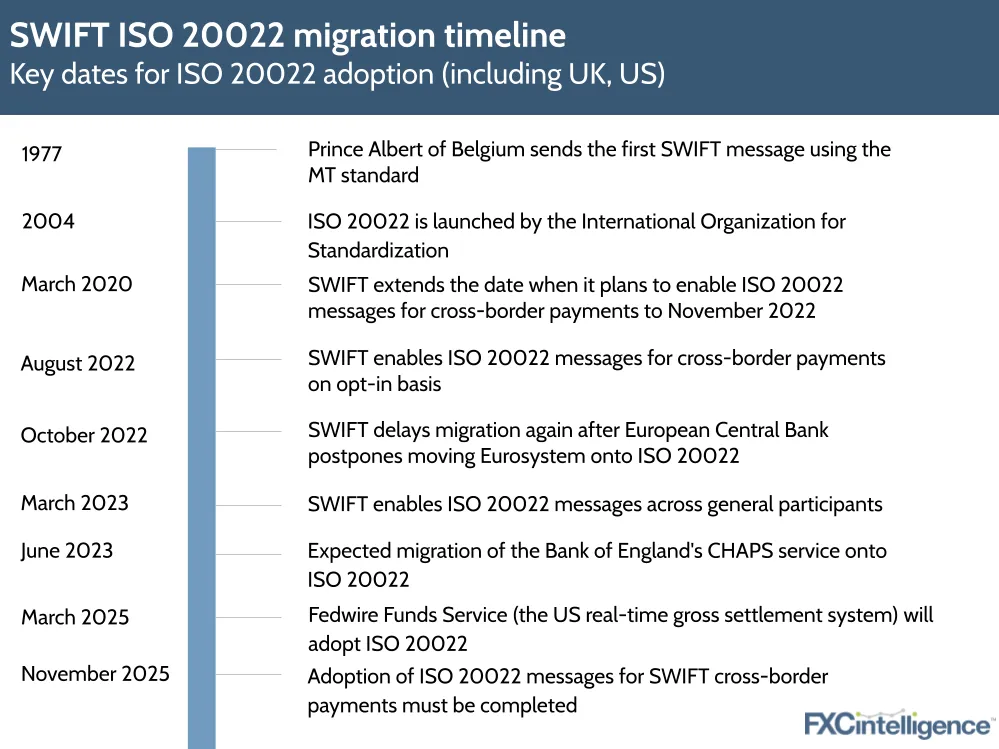

While many banks and FIs globally are currently in transition, ISO 20022 adoption is expected to be universal by November 2025, when SWIFT is scheduled to retire its existing MT message standard for for the ISO standard MX format. The benefits of ISO 20022 adoption are many.

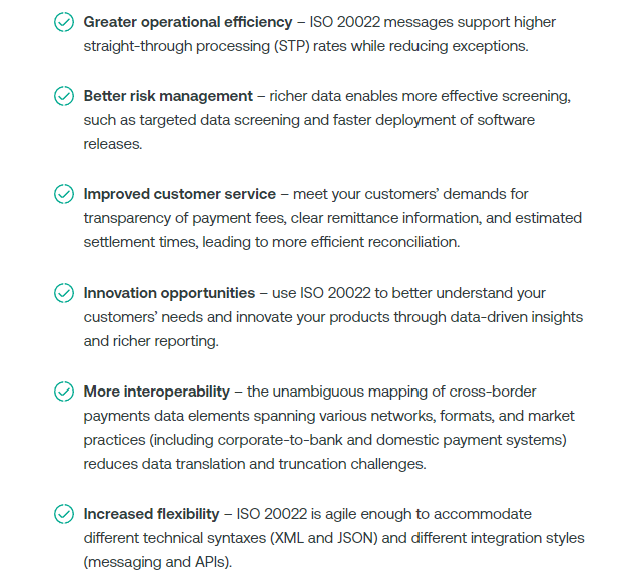

Flexibility

ISO 20022 is more easily adaptable then current messaging standards, making it more responsive emerging technologies, to changes in the economy, and innovation.

Compliance and regulation

With richer data, businesses have more improved fraud prevention measures to help target financial crime. The higher level of detail required, and the identical standards, protocols and formats implemented allow better regulatory reporting, more secure payment information.

Harmonization

ISO 20022 will create more interoperability between payment systems around the world, streamlining cross border payments, which will have a positive impact on market infrastructures, improving processing time and accuracy.

Improved Straight-through Processing (STP) rates

In the payments industry, efficiency is typically measured by assessing the level STP - or the percentage of transactions that are passed straight through the system from start to finish with less manual intervention, resulting in fewer delays for end customers.

Enriched data

Banks and financial institutions alike will benefit from more enriched, structured data provided by ISO 20022 messaging. Around 10 times more data about each payment can be sent, including the purpose of the payment, the original source and ultimate beneficiary. Enhanced information in data fields creates better crime risk management processes, as well as seamless interaction with AI and ML.

Creating potential new revenue streams

ISO 20022 improves liquidity management by providing a new level of financial communication, enabling the adoption of data analysis solutions, more accurate transaction monitoring, and added value services that can provide customer insights.

Standardizing non-Latin alphabets

An important consideration is that the ISO 20022 standard will allow longer references for non-Latin alphabets, with a character set ten times larger than MT messages, and carrying a great deal more information. This is a functionality that was widely explored in China.

Why standardization is important

Standards are a critical factor when initiating financial transactions and reporting financial activity. An international standard is a way to simplify interoperability between service providers and clients, and enable the efficient, consistent and secure exchange of files.

As a flexible framework, the ISO 20022 financial messaging standard provides an internationally agreed business message syntax, where user organizations and developers will use the same message structure, form and meaning to exchange transaction information globally across all major currencies.

Watch our webinar ISO 20022: A global shift in the payments industry

ISO 20022 and cross-border payments

The ISO 20022 common standard will change the way banks relay cross-border payments instructions. Some banks are already prepared, while others have a lesser degree of readiness. A break in the chain could mean the potential loss of vital information. The consequences of this are a direct reflection on the bank seen to be the weaker link.

For more information on cross border payments, take a look at our guide

ISO 20022 and High Value Payments (HVPs)

SWIFT, along with major global banks and market infrastructures have formed the HVPS+ market practice task force to create a road map to harmonization for higher-value payments and real time gross settlement (RTGS).

"Harmonizing messaging standards across HPVs will create efficiencies for payment system participants and establish the foundation to develop new services.” Michael Knorr, Head of Payments & Liquidity Management, Financial Institutions Group, Wells Fargo Bank

HVP systems play a crucial role in international finance, so monitoring these large value payments systems with the right monitoring and performance management solution is critical.

Read more about how RTGS is changing the global financial landscape here.

What is ISO 20022's impact on banks?

The ISO 20022 message format is vital to instant payments and plays an important role in the overall modernization of payment processes.

Banks can move from end-of-day batch file processing to real-time payment processing. Additionally, ISO 20022 messages provide the opportunity for enhanced analytics which can lead to offering valuable new levels of payment services to the customers and clients of all financial industry players.

As ISO 20022 involves the processing of much larger data volumes compared to conventional legacy formats, bank systems and databases will need to be capable of processing these larger volumes, and at higher speeds. This encompasses cross border payments, real-time payments, daily liquidity management, compliance checks, and fraud detection and prevention.

It's essential that there is enough of a time allowance for testing to ensure that all syntax and formatting information is correct, and that the data is mapped correctly within all associated payment and clearing systems.

Corporate clients need to be informed about the additional data that will potentially become available, and how it will be used.

Key challenges of ISO 20022 implementation

As with any major system migration, there needs to be a balance between meeting deadlines, and solidifying a future-proof state. However, the complexities of ISO 20022, along with interdependencies of implementing new industry standards can create some challenges in business areas and market practices.

The cost of implementation

Any legacy or outdated technology used by payments providers that pre-date ISO 20022 will need to be reviewed, mapped and translated to the new standard. This includes the correct rules for AML, fraud and compliance checks. This of course, involves budget, which needs to be agreed upon between financial institutions, stakeholders and partners.

Timelines and deadlines

With different markets setting different deadlines for ISO 20022 adoption, payments firms operating across borders need to carefully plan their migration strategy, and the high-stakes complexities that go with it. Many banks are also contending with other transformation projects, so they need to ensure that their migration solutions are solid, not simply 'designed to budget' and providing a poor fit in the long run.

Managing additional information

ISO 20022 messages can be hundreds of times longer than standard payments messages. This dramatic expansion of data means that infrastructures will need to be redefined to manage the additional ISO 20022 information. Each and every character within a message has to be 100% aligned with the specifications. The format is validated at several steps along the communication channel chain on the sending and receiving sides. Even a single missing colon could result in a multi-million transfer being rejected or delayed for days.

The importance of real-time payments analytics

Real-time payments analytics are vital to measure, view growth and make decisions all the way through the payments chain, and across each different platform. This is even more important now with the impending global ISO 20022 migration.

How IR Transact can help

The benefits that ISO 20022 will provide are valuable, but complex to decipher on older legacy systems. This is where IR Transact's High Value Payments solution can help with efficient reconciliation, and enabling financial institutions to detect anomalies or suspicious activity immediately.

Our solution provides a single dashboard to monitor the health of your high value in-flight transactions across payment queues and delivers and end-to-end view of transactions impacting associated bank accounts.

Monitoring with IR Transact is non-intrusive, and integrates seamlessly into the existing enterprise environment, bringing real-time visibility to the entire payments ecosystem. It collects data from all silos across the payments system, filters, correlates and analyzes this information, bringing it into a single application.

Keeping on top of emerging technologies, regulatory changes and the introduction of new international payments standards is challenging. With ISO 20022 migration imminent, turning information into intelligence will assure the safe, efficient operation of payments systems worldwide.

Download the IR guide to managing your changing payments environment

Contact us to discover how IR's payment monitoring solution can help your business.