Banks have been an essential part of the global financial ecosystem since the 18th century. Almost every country in the developed world now has a central bank which has a number of financial and political functions, including serving as banker to their own governments.

Banking liquidity depends on a bank being able to meet its payments and withdrawal demands, such as the funding of new loans or servicing customer account withdrawals, using only available liquid assets.

How bank liquidity can curtail a financial crisis

If a bank can't meet its financial obligations, it could risk bankruptcy - and as most banks are interconnected with other banks - cause a potential financial crisis.

As in the case of the financial crisis of 2008, when U.S. banks did not maintain sufficient liquid assets to meet financial obligations. When many banks experienced unexpected mass withdrawals of depositor funds, and were left holding billions in unpaid loans by borrowers during a massive downturn in the housing market, they faced a liquidity crisis, and became insolvent. To prevent a total economic collapse, the U.S. government had to intervene.

As a result of what happened, a liquidity coverage ratio rule was created by the Basel Committee on Banking Supervision in 2009 to ensure that banks keep enough liquid assets on hand to avoid it happening again. The third Basel accord or Basel-III is the foundation of global banking supervision.

Under these liquidity regulations, the Basel Committee ruled that all banks must maintain sufficient liquid assets in reserve that equal or exceed 100% of their total anticipated expenses for a 30-day period.

These liquidity risk management reform measures were created to improve regulation, supervision of liquidity requirements, and risk management of liquid assets within every bank in the international banking sector.

Image source: PKC Advisory

In this guide, we'll explain the importance of liquidity risk management in banking organizations and financial institutions. We'll cover in detail why high quality liquid assets within the banking system are critical, not only to sustain bank lending practices and meet withdrawal demands, but to maintain economic growth.

Want to know more about liquidity management? Read our guide

Best Practices for Liquidity Management and Mitigating Risk

What is liquidity in banking?

The core business of the banking system is funding loans (illiquid assets) from which it earns interest income, and investing cash deposits (highly liquid liabilities) from which it earns investment returns. This is the basis of liquidity creation

Banks create liquidity by having enough funds (cash deposits) in reserve to allow depositors to withdraw money on demand.

Liquidity creation becomes compromised when problems occur between the funding and the asset side of the balance sheet. In other words, when the balance sheet shows that a bank has insufficient cash deposits (or assets that can easily be converted to cash) to meet financial obligations to depositors and other creditors.

Bank capital, and bank liquidity: What's the difference?

To properly understand what banks do, the risks they face and how they mitigate those risks, it's important to know about bank capital and bank liquidity.

Liquidity is a measure of the money and other assets a bank has readily available to quickly pay bills and meet financial obligations in the short term.

Capital is a measure of the resources available to a bank to absorb losses.

Many people mistakenly think that capital is held in reserve like an asset, or kept aside by banks to use for emergency funding, but capital is not an asset. Capital is best described as the difference between all of a bank's assets and its liabilities, and serves as a financial safety net to absorb losses. To maintain solvency, have plenty of capital on hand, and maintain liquidity creation, the value of a firm's assets must exceed its liabilities.

Why is liquidity important?

When asset values deteriorate and monetary policies become tighter, it increases liquidity risk for banks.

With a history of bank failures due to inadequate balance sheet management, commercial banks are now required to manage their liquidity risk through effective asset liability management (ALM).

As banks have failed or needed government assistance due to inadequate capital, lack of liquidity, or a combination of both, the Federal Reserve Bank has worked to mitigate the factors that threaten the levels of both liquidity and capital at banking organizations.

As a last-resort emergency measure, The Federal Reserve System can intercede as lender, providing liquidity to the banking system. For example, The Federal Reserve can buy government securities on the open market, which drives more money into the banking system.

Find out more about managing liquidity risk in our guide

Understanding Liquidity Risk: Causes, Measures & Management

Bank liquidity risk

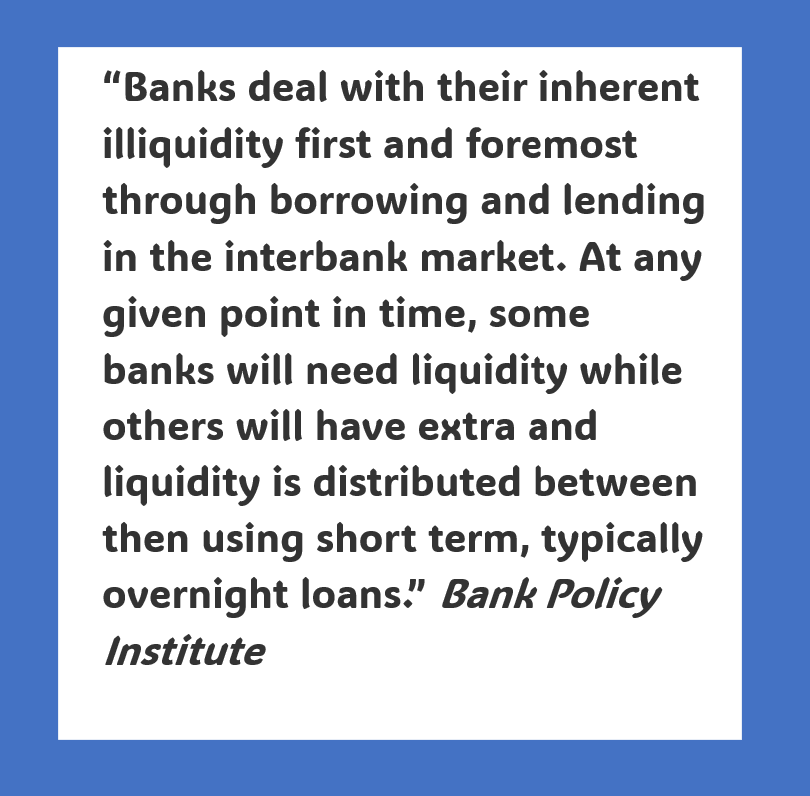

If a bank is suddenly faced with an unexpected outflow of money through large withdrawals, credit disbursements, or market instabilities it may become significantly less liquid. It may also be exposed to risk if for example, any markets it depends on are subject to their own loss of liquidity.

Liquidity risk has a cascading effect and often tends to exacerbate other risks such as credit risk and market risk. If a bank's borrowers want their money, and the bank does not have enough cash on hand, the bank can become illiquid.

If a trading bank has assets that cannot be sold quickly, its inability to liquidate that position at short notice can lead to market risk

Liquidity

Liquidity is a measure of the amount of cash money and other assets that banks and financial institutions have available to quickly pay bills and meet short-term business and financial obligations.

Liquid Assets

Liquid assets are described as funds and assets that can be converted to cash quickly if needed to meet financial obligations. Examples of liquid assets generally include central bank reserves and government bonds. To remain viable and avoid insolvency, a bank needs to have enough liquid assets to meet withdrawals by depositors and other obligations that fall due in the near term.

What is the Federal Deposit Insurance Corporation (FDIC)

The Federal Deposit Insurance Corporation is an independently operated federal agency that insures deposits in U.S. banks and financial institutions in the event of a liquidity crisis, or bank failure.

It was formed in 1933 to help maintain public confidence and encourage stability in the financial system by promoting solid banking practices. While being FDIC insured isn't mandatory, those banks who are members use the fact that they're insured as a marketing point. In other words, an uninsured bank will not be able to compete effectively in an industry where consumers expect their money to be protected.

As of 2023, the FDIC insures deposits up to $250,000 per depositor as long as the institution is a member firm, so it's critical for bank customers to confirm before making investments that their bank is insured.

How banks use loans to create liquidity

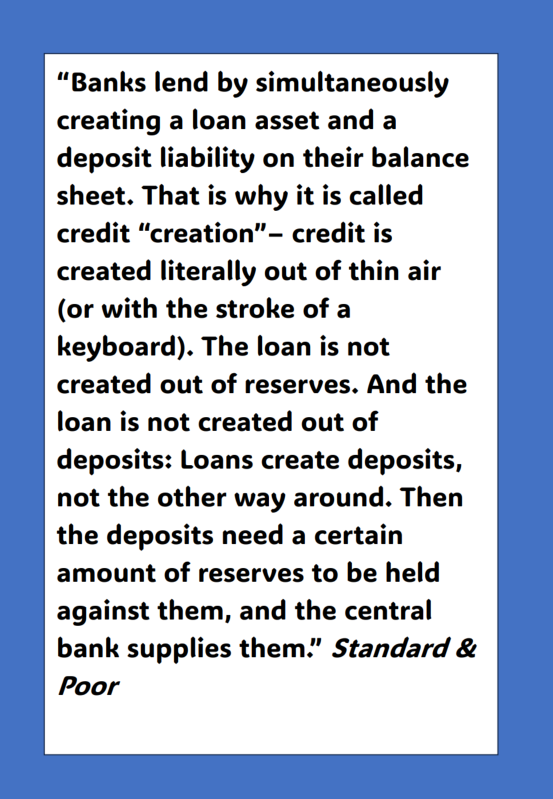

Liquidity creation, or the creation of new money, happens through the accounting process that banks use when they make loans.

Liquidity creation is not about the physical (paper) cash that carries the seal of the Federal Reserve. The electronic numbers that appear on the screen when you check your account balance at an ATM are in reality accounting entries that represent a bank's ‘liability’ to you - or a 'promise to pay' when you use your debit card or online banking.

A Bank of England report states that “Commercial [i.e. high-street] banks create money, in the form of bank deposits, by making new loans. When a bank makes a loan, for example to someone taking out a mortgage to buy a house, it does not typically do so by giving them thousands of pounds worth of banknotes. Instead, it credits their bank account with a bank deposit of the size of the mortgage. At that moment, new money is created.”

Measuring liquidity

Regulators who oversee liquidity requirements use financial metrics called ratios to determine whether banks, financial institutions and insurance companies can sufficiently cover their liabilities. Liquidity measurement is also about utilizing the cash that their activities generate to obtain a return.

A bank, for example, uses funding from customer deposits for lending out as mortgages and other loans. The balance of customer deposits remaining may be kept as cash, or invested in liquid assets.

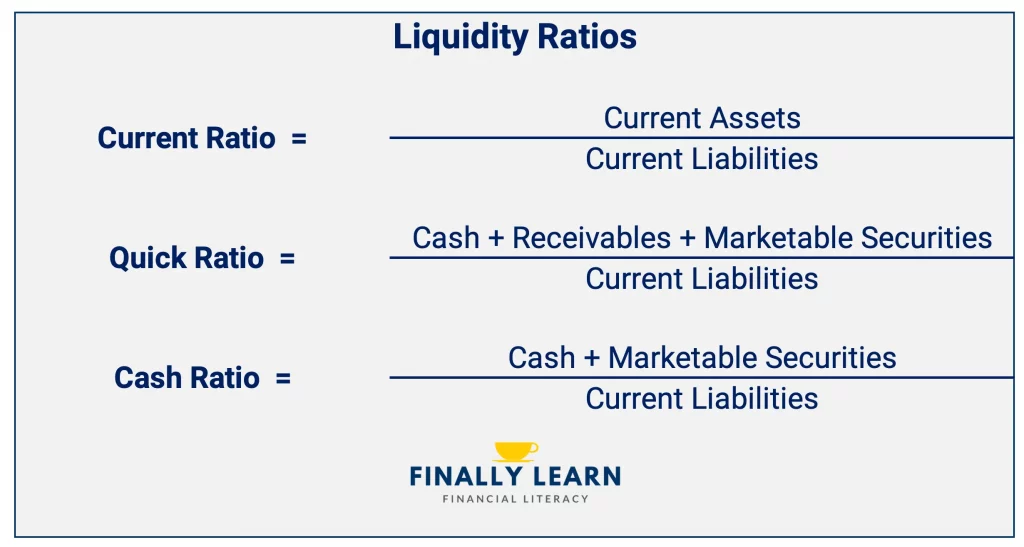

There are three basic liquidity ratios:

1. Current ratio

Current Ratio = Current Assets / Current Liabilities

The current ratio is the simplest metric on a balance sheet, and is calculated by dividing current assets by current liabilities to arrive at the current ratio.

2. Quick Ratio

Quick Ratio = (Cash + Accounts Receivables + Marketable Securities) / Current Liabilities

The quick ratio metric is similar to the current ratio, however, it only takes into account particular current assets. It includes more liquid assets such as cash, accounts receivables and marketable securities, but omits current assets such as inventory and prepaid expenses.

3. Cash Ratio

Cash Ratio = (Cash + Marketable Securities) / Current Liabilities

This ratio metric goes even further by considering only a company’s most liquid assets – cash and securities, which are the most readily accessible to pay short-term obligations.

Real-time payment processing benefits liquidity management: How IR Transact can help

Being able to see the full financial picture is at the core of effective liquidity management for banks, financial institutions and enterprise organizations. For any organization, making the right decision at the right time, and maintaining a healthy balance sheet is dependent on having visibility into every transaction as it happens in real time.

Managing data collection and deep, dynamic insights and analysis of that data has never been more crucial to ensure that an organization remains financially viable.

IR Transact simplifies the complexity of managing modern payments ecosystems, bringing real-time visibility and access to your payments systems so that you can manage your liquidity and market risk.

Transact can help give organizations unparalleled insights into transactions and trends to help turn data into intelligence, offering a thousand points of reference, from a single point of view.

Find out how IR Transacts High Value Payments can simplify the complexity of managing your entire payments environment