The rapid rise of eCommerce, spurred on exponentially by the pandemic, has broken down economic borders, enabling many businesses to attract and transact with customers anywhere in the world.

It’s never been more important to offer the right local payment methods to meet your customers’ preferences wherever they’re located. If you don’t, you’re missing out on opportunities to increase growth, reach new customers and reduce operating costs.

The customer-driven economy

Evolving customer expectations are driving today’s economy. Consumers expect to be able to pay for their goods and services how they want, and they expect a seamless payment experience. But even if you are offering the local payment methods your customers prefer today, those preferences may not remain static for long.

As new ways to pay are continually emerging and gaining popularity across different regions and countries, businesses need more than ever to remain on top of payment trends and frequently review their payment strategies.

This means you need access to data and insights that show:

- Where your customers live and transact

- How they buy (i.e., online, mobile, in person)

- What they’re buying and how often

- What payment methods they’re using

Different global payment preferences

The world of payments is complex, so developing strategies to encompass the different types of payment preferences in different global regions takes planning and resources.

While research suggests that the major card brands have a market share of around 23% worldwide, more than 70% of all consumer transactions are paid via digital wallets, bank transfers and cash-based payments.

Outside of North America, for example, international credit cards (e.g., Visa, Mastercard, Amex) are not always the most used payment methods. Even throughout Europe, different countries have different payment preferences. And in China, only a small percentage of shoppers pay with international credit cards.

Given these diverse market specifics, its clear that businesses, regardless of size or industry, need a payment acceptance approach tailored to each country to increase market reach.

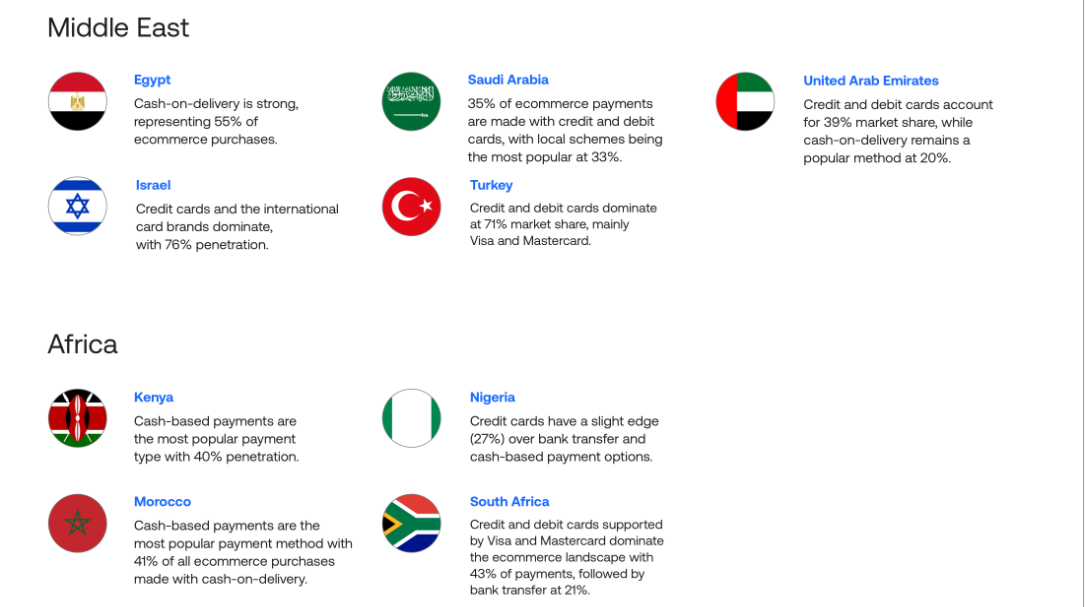

Below are some of the preferred payment methods by country:

Image source: Global Payments Inc.

Image source: Global Payments Inc.

The global cross-border eCommerce opportunities for businesses are immense. In 2020 alone, research suggests that eCommerce accounted for $3.914 trillion globally.

Businesses do need to tailor their payment choices to meet consumer demands, however most businesses only need to select a few to truly meet the needs of their customers. To identify the right mix of payment options, you’ll need to consider the following:

- Where are the majority of your customers located? It’s important to explore the most popular online payment methods in that region.

- Where do you conduct the majority of your business? If you have multiple locations, it’s important to offer payment methods for each location.

- What platforms and devices are they using to buy? Are they using a laptop, mobile device, tablet? Do they prefer to pay with digital wallets, cards or buy now, pay later (BNPL) options?

- Are you thinking of expanding into other countries? It’s important to set up the infrastructure that offers the preferred payment types in that country.

In a competitive and diverse consumer-driven economy, businesses can’t hope to be successful unless they closely follow payment trends. If you don’t offer the payment preferences that customers want, they will find a competitor who does.

How data translates to valuable insights

The key to success for any business today is to base their marketing strategy on data-driven and data-informed decisions. The payments industry generates incredibly large volumes of data, and managing it to extract the specific insights they need is a crucial part of that strategy.

Insights are crucial to provide better service and a deeper understanding of customers. For example, why a customer is facing a negative experience at the point of payment, such as declines, slow response times of transaction timeouts.

Visibility across your entire network, especially the customer facing touchpoints, along with the ability to drill down and accurately pinpoint anomalies and analyze them provides invaluable insight into the customer experience.

Analytics drive business growth

Analytics-driven strategies can increase profits by reducing costs and optimizing revenue. Analytics deliver real-time intelligence and actionable insights that no business today can afford to be without.

Transaction volumes are increasing, new payment methods are constantly emerging and growing customer demand for a seamless, personalized payments experience means businesses need to keep up.

How IR Transact can help

Monitoring and analyzing payment transactions with IR Transact gives you the power to see inside your payments organization – through a single solution. How?

- By using one tool to monitor and manage multiple vendor solutions across on-premises and cloud deployment models

- By optimizing the commerce that connects global economies

- By providing real-time visibility into transactions 24/7

- By enabling dynamic thresholds and alerts for anomaly detection

- By turning transaction data into actionable insights with customizable dashboards

- By allowing you to translate complex data sets into straightforward, easy-to-understand representations

Find out more about how IR can simplify complexity using payments data

Watch the webinar