In the last twelve turbulent months, the payments industry worldwide has undergone a metamorphosis. Globally, businesses are moving away from cash and adopting touchless and online payments methods as the way forward. While COVID-19 has accelerated the adoption of new payments approaches and technology, it’s consumer behavior that has been the major driver.

2020 – a year of learning

With rapidly changing market circumstances necessitating flexibility with business operating models and, businesses now more than ever need solutions to help them leverage emerging technology effectively, and take advantage of all the exciting opportunities it presents.

2020 was a year of short-term focus on survival, and learning. As we launch into 2021, we can now review what we learned, optimize those new approaches, and plan more efficiently for the future. Here, I’ll reveal some expert insights and investigate key trends in the immediate future of payments - watch the video below or read on!

What the new normal will look like

From the growing realization of the importance of customer experience, to the rapid adoption of technology and digitization, the new normal has arrived with lightning speed.

Digital payments and contactless is here to stay

Digital apps are becoming more appealing than ever in the lives of day-to-day users. While cards dominate in-store retail payments, mobile wallets are paving the way for the future of payments. Predictions suggest the global mobile wallets industry will increase by almost 50%, to reach a value of $1.47trillion throughout the COVID-19 pandemic, with more than 1.7billion people using mobile wallets by 2024.

But it’s not only retail that’s benefiting from the digitization of payments. Real time mobile P2P payments, digital remittances, and digital business payments are burgeoning throughout the payments ecosystem.

More focus on user experience

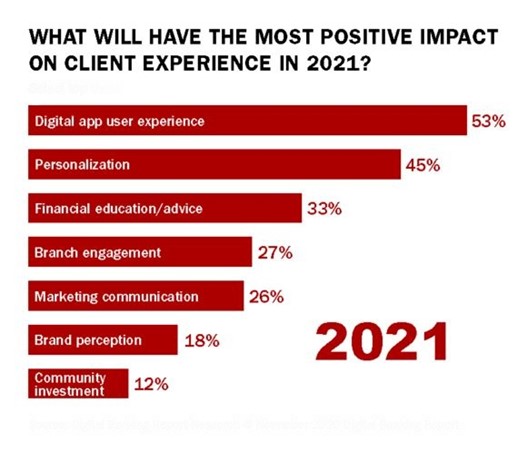

The foundation of an improved customer experience is to know your customers and give them what they need. The key is to implement data and advanced analytics - not just to find out more about the customer - but to use that data to constantly demonstrate an understanding of the customer journey. Without deploying the tools to gather insights for customer communication, businesses will miss the opportunity to create a better service, and ultimately lose the customer.

Improving experience from a customers’ perspective, will provide increased satisfaction, boost sales, expand relationships, and increase retention.

Source: Digital Banking Report Research – November 2020

Source: Digital Banking Report Research – November 2020

More use of technology

The focus on technology was already happening prior to the pandemic. But with extended periods of social distancing, remote working, and the other challenges of staying afloat during the crisis, the adoption of new technology to facilitate digital banking has sped up even more.

Many businesses are finding it necessary to invest in new tech infrastructures, or upgrade their old systems to keep pace with ever-increasing demands in the world of payments. Customers won’t settle for anything less than a fast, secure, reliable, and frictionless payment system, so businesses need to continually plan, budget, and build their digital and physical infrastructure. Amidst all this, they need to maintain compliance with standards and regulations.

Performance management tools are mission critical

To move forward, and truly optimize the decision-making process, we need data and detailed insights. To extract this data, businesses need performance management tools that can encompass all disparate technologies and systems. This makes it easier to uncover vital insights about consumer behavior and payment preferences – and to scale for the future.

Organizations that have these tools in place will be far better informed as to where to invest, and where to divest, what’s working and what isn’t.

Access to data gives businesses insights into customer preferences, buying habits, the experience they receive while making a payment, and even how payments vendors are performing. Quite simply, payments performance management tools can help take a business from just surviving – to thriving.

The fintech space is continuing to evolve. Whether you’re a retailer, acquirer, or payments processor, it’s crucial to have complete visibility into your payments environment. The ability to accommodate new technology, deliver on SLAs and gain business insights is what will drive digital transformation into the future.

Want to find out more about how to manage the evolving complexities of your payments environment? Download our essential guide.